For years, the number of stars has been the main reference for understanding the position of a hotel in the market. Currently, in an environment where perception of value, the customer experience and the global offer weigh more and more, focusing exclusively on the category can lead to decisions that are poorly aligned with reality. Today, looking beyond the compset traditional and star is not only recommended: it is necessary.

Why is the traditional category no longer enough? It’s time to move towards more in-depth hotel benchmarking

Travellers compare experiences, not technical definitions. A guest in search of a charming getaway might weigh up both a 3-star boutique hotel and a standard 4-star.

Which one do they choose? The one that offers better value for money, regardless of its official category. In that decision-making process, your competition isn’t just the hotel they end up booking — it’s any option they seriously consider.

This means that other hotels in your area — even if they differ in category or type — are influencing the perception of your price, your value, and ultimately, your market share.

And this is where smart hotel benchmarking comes in: a sharper, more relevant way to understand your position within your wider compset — including all the hotels that genuinely influence your potential guests’ booking decisions.

So, what is Smart Hotel Benchmarking?

Smart hotel benchmarking involves comparing your price and value proposition with the relevant set of hotels your potential guests consider when booking. This means adjusting for differences in category, services, reputation and perception to provide a fairer and more insightful assessment. This flexible, contextual approach lets you identify the real influences on your customers’ decisions, refine your pricing, and understand whether your hotel sits inside or outside the market — seen through the eyes of the consumer, not just your own.

Unlike traditional revenue and pricing strategies — which rely on setting prices by comparing a handful of competitors with similar characteristics — this approach is dynamic, realistic, and far better aligned with how customers behave today. It enables you to understand, through comparison, how a hotel you wouldn’t normally consider as a competitor would be perceived if it shared the same characteristics as your establishment, but seen from the perspective of a potential guest.

The compset: the ecosystem that shapes your market

How many establishments do you monitor when you’re doing rateshopping? And how many do you actually consider when setting your pricing strategy? Although official categories still exist, most travellers make decisions based on perception — comparing photos, services, location, reviews, and above all, value for price. That’s why limiting your analysis to a traditional compset, rather than an extended one, risks overlooking competitors who are influencing your performance.

Understanding how other hotels position themselves in your market — even those you don’t see as direct rivals — can be the difference between reacting too late and staying one step ahead with a sharper strategy.

Hotel benchmarking tactics to gain a clearer understanding of your true position

Here are some ideas for Smart Benchmarking to use the compset as a tool for analysis and decision-making:

- Value perception analysis: What do your customers perceive in relation to what you offer? Compare your proposal by adjusting for category, online reputation and services.

- Contextual monitoring: Observe promotions, trends and hotel strategies competing for the same profiles, even if they’re not in your compset.

- More realistic price optimisation: Use algorithms that take into account real differences in category and rate, not just structural similarities, to know if your rate is inside or outside the market.

- Collaboration or active differentiation: Leverage your compset knowledge to better differentiate yourself — or even explore synergies with other local hotels.

- Extended benchmarking: Or dynamic segmentation of the compset — create your own dynamic comparison set that includes different types of hotels based on season, customer profile or strategy.

How to do it efficiently and make the most of your time?

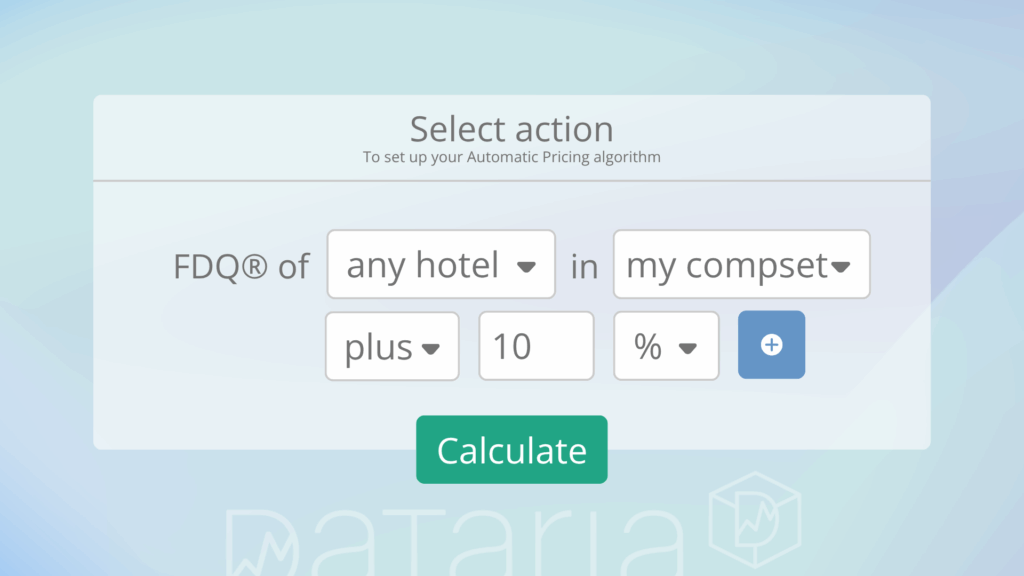

💡 At Dataria, we’ve developed the innovation indicator DFQ (Fair Dynamic Quality), an algorithm designed to take benchmarking to the next level. It automatically adjusts for rate, category and perception, allowing you to compare your hotel with any other on the market and gain a clear understanding of whether you’re well positioned or need to take action.

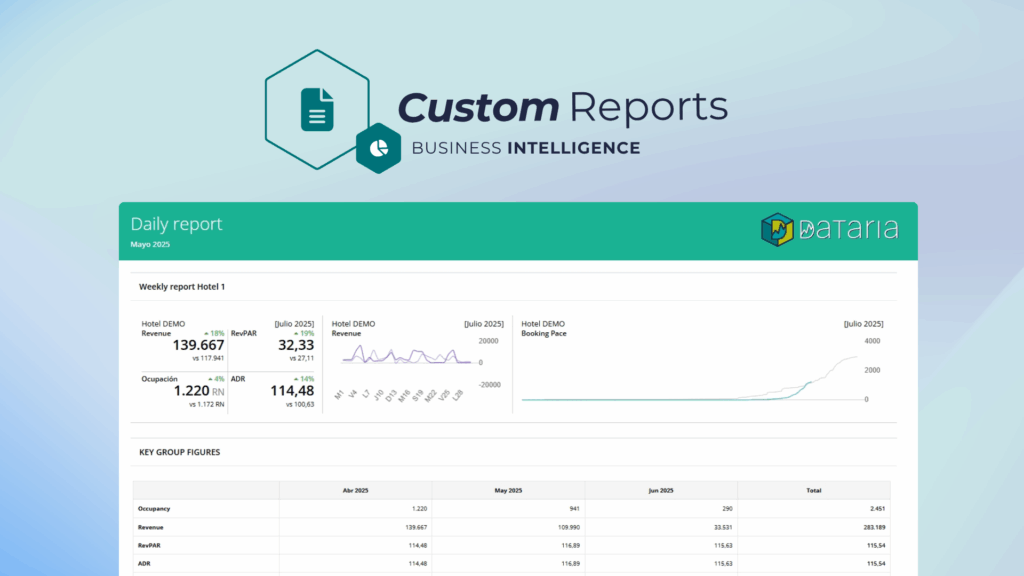

In addition, by combining this with other features in our suite — such as Automatic Pricing RMS — these criteria can be applied to automatically set rates, which are then sent directly to your Channel Manager for publication. You can take it further by evaluating results through automated reports based on key KPIs, covering everything from revenue to email performance.

Fancy seeing it in action? We’ll walk you through it step by step in a demo.